France leads the way in EU investment property sales, the latest market figures suggest.

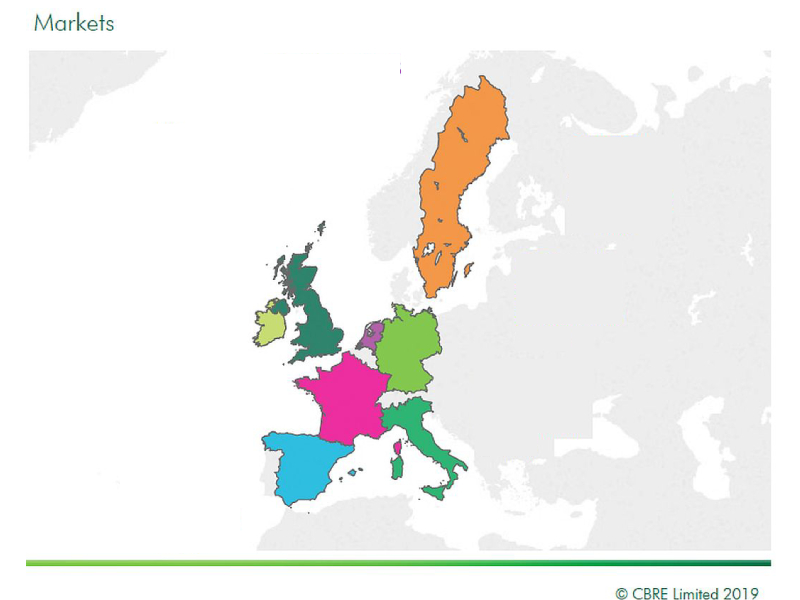

Sales in France in the year to Quarter 2, 2019, rose 5% to €8.5billion in the quarter and €34.6billion in the previous year, says international property agent, CBRE.

With availability down and Brexit worries persisting, the only sector to see a rise in Europe is hotels, which was up 4% to €6billion in the quarter and €24.3billion in the last 12 months. That is according to the latest European Investment Market Snapshot from CBRE for Q2, 2019.

Annual EU investment property sales at €293billion

In total, annual real estate investment in Europe reached €293billion – an 8% year-on-year fall due to a lack of quality product and fewer ultra-large transactions in key destinations. The total for Quarter 2 was €65.3billion.

In Germany, Europe’s largest market by volume, investment property totals were down 8% to €16.3billion in the quarter and €71billion in the year. Limited product availability and keen pricing have hampered growth.

Looking at the UK, the effects of a late cycle market and Brexit uncertainty are together putting pressure on sale values, which are down 20% to €10.6billion in the quarter and €61.5billion in the year.

Sale values were down 11% in the Netherlands to €4.1billion in the quarter and €18.1billion in the year.

Among the smaller European markets, sale values rose in Spain by a strong 38% to €2.6billion in the quarter and €17.7billion in the year and in Italy they increased 9% to €3.5billion in the quarter and €10.3billion in the year.

They also increased in Ireland by 13% to €1.5billion in the quarter and €4.4billion in the year.

Totals in Sweden were similar to Italy’s, at €3.6billion in the quarter and €10.6billion in the year, but that was down 17%.

The office sector is the biggest at €26.9billion in the quarter and €122.6billion in the year, a fall of 2%.

Next comes residential at €11.6billion in the quarter and €45.9billion in the year.

Retail fell 31% to €8.9billion in the quarter and €40.7billion in the year.

Industrial was down 2% to €6billion in the quarter and €32billion in the year.

Investment in other sectors was flat at €5.7billion for the quarter and €27.7billion for the year.

Consorto has news on the latest commercial real estate deals.