Rising online sales are creating more demand for warehouse space across Europe – and growing investor interest.

In 2018, there was a record take-up of logistics in Europe and the first six months of 2019 has seen resilient deals, says Savills in its European Logistics Spotlight.

“An increase in online spending creates more demand for warehouse space. Given the rise of ecommerce and forecasted growth rates across Europe it is therefore no surprise that we are experiencing unprecedented levels of demand from investors for the sector.”

Logistics take-up reached 11.9million square meters across the European markets Savills tracks in H1 2019. This is in line with the five-year average.

Germany leads logistics sector

This was led by Germany on 25% (2.9million square metres), followed by the Netherlands on 16% (2million square meters, Poland on 15% (1.8million square meters), the UK (12%) 1.5million square meters and France (12%) 1.4million square meters.

Demand is highest from e-commerce and the manufacturing sector and demand is set to continue to gather pace, as third-party retailers and e-commerce operators expand.

“With the average yield for European Logistics coming in another 70 basis points through last year, a lot of this growth is being priced in already so investors need to be very confident that it will come in order to get comfortable with the entry pricing,” says the report.

“There will therefore be continued focus on urban locations, on areas with good transport links, where there is cheap and available labour and, increasingly, reliable and high levels of energy supply.

“At a country level, there will be a focus on high GDP growth, consumer spending habits, technological advancement. At a real estate level then, the key metric to monitor is vacancy rates.

“These are very low across Europe when you consider the levels of demand we anticipate from the growth of ecommerce to come. This will drive rents but we also need more development.”

Vacancy rates continue to fall across Europe, particularly in the core markets and this should boost rental growth prospects in the short to medium term, as limited new speculative developments are unable to keep up with the growth in demand across the majority of markets.

Run-down of national markets

Here is a run-down of the national markets:

Czech Republic take-up reached 722,000 square meters in the first half of the year, 13% above the H1 five-year average. Rents are unchanged at €58 per square meter in Prague and with the national vacancy at only 4%, this could apply upward pressure to rents.

Romania’s logistics vacancy rate is 5.5% for H1 2019. Mid-year take-up reached 124,000 square meters during H1 2019, around 18% above the five-year half-year average. Bucharest accounted for around 70%, with prime rents unchanged at €48 per square meter.

In Poland, new logistics developments are forecast to reach 2.5million square meters by the end of 2019. A slowdown in German manufacturing in 2019 may impact industrial production in Poland, although logistics demand is likely to be offset by e-commerce growth and stable private consumption> Rents are predicted to remain steady.

Prime rental growth at 5%

A shortage of options in Germany’s top five markets could see prime rental growth reach around 5% over the next 12 months, due to rising construction prices. In 2018, leasing volumes exceeded 7million square meters, while in the first six months of 2019, 2.9million square meters was leased.

Logistics take-up in H1 2019 in the Netherlands was limited by available space. The national vacancy rate is 7.1%, the lowest since 2010. The growth of ‘agglo-logistics’, secondary industrial locations near large cities, will help meet rising demand for shorter delivery times.

Semi-industrial and logistics take-up in Belgium reached a combined 699,000 square meters in H1 2019, close to the long-term average. Savills expects full-year logistics volumes to be in line with last year at around 700,000 square meters.

France logistics take-up reached 445,000 square meters in H1 2019, around the five-year average level for H1. Île-de-France accounted for 32% of leasing activity. Rents remain at €52 per square meters, similar to year-end 2018.

Spain’s strong economic performance continues to boost demand for logistics space. Rents in Madrid (€66 per square meter) have risen 2% and Barcelona (€84 per square) by 4% during the first half of 2019. New speculative development in Madrid has increased the vacancy rate to 9.3% in the first half of the year, however, the strongest level of take-up in Q1 in Barcelona, has pushed the vacancy rate to below 4%.

Portugal’s logistics take-up reached 69,000 square meters in the first half of the year, despite e-commerce accounting for around 5% of total retail sales in Portugal. The figure is 7% above the five-year H1 average. Rents rose 11% in this period.

Rising online sales boost UK take-up

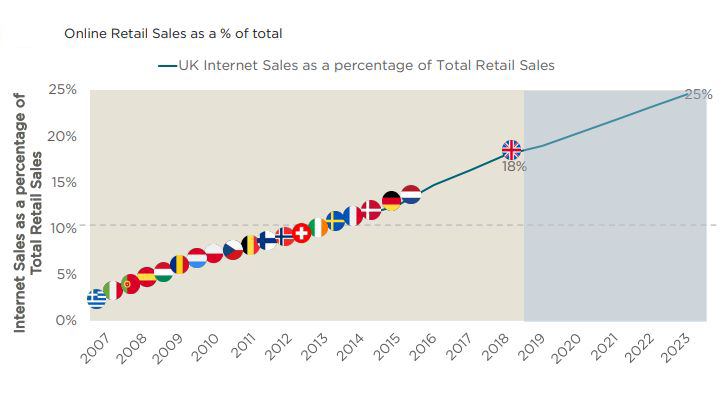

In the United Kingdom rising online sales in the retail sector idrove

Rising e-commerce sales in Ireland contributed to take-up in Dublin in H1 2019 of 181,000 square meters, 32% above the five-year H1 average. Limited development activity in Dublin has resulted in a falling vacancy rate of 3.6% and prime logistics rents have risen 5% to €105 per square meter.

New developments in Sweden continue at healthy levels, with 600,000 square meters being completed in 2019, close to the 2018 record. It is likely the logistics and industrial sector will experience another record year.

Spain and Italy, with only around 5% of total retail sales currently made online, are forecast to see the strongest rising online sales growth of all Western European markets over the next five years at 17% per annum and 21% per annum respectively, Savills predicts.

Find out why Europe is the top cross-border CRE market.