The US-China trade war and Brexit uncertainty have slowed European commercial property investment – but the hotel sector is forging ahead.

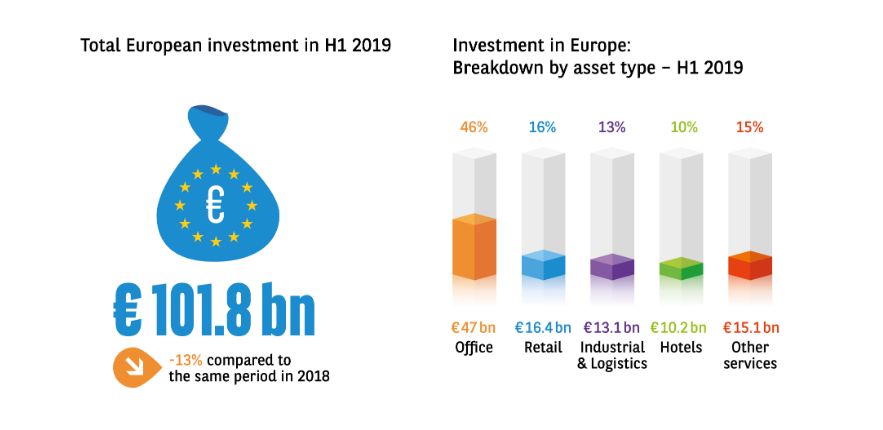

Investment levels in the first six months of 2019 reached €101.8 billion, which is 13% lower than the record in 2018, says the latest industry update from BNP Paribas Real Estate. Just like economic growth, the US-China trade war has slowed investment levels.

Hotel sector is shining star

The shining star is the hotel sector, which rose 26% to €10.2 billion, Just €0.5 billion from the 2015 record. The figure was boosted by several major deals, particularly portfolios in Italy, France and the Czech Republic.

The office segment was down 6% to €47 billion, although it was held up with two transactions of over €1 billion in Paris and many major deals in the leading German markets.

Logistics fell 16% to €13.1 billion, but is still 30% above the long-term average.

The retail segment saw the biggest decline of 31% with

Germany attracts highest investment

Germany attracted the highest investment and Berlin was at at record levels. Levels fell 6% to €24.4 billion, but were still around the five-year average. In other cities the fall was due to a lack of assets rather than weaker demand.

The UK, which usually leads the way, was in second place with investment of €22.1 billion, down a massive one-third on H1 2018 and also well below the long-term average. The uncertainty of Brexit meant many investors put their investments on hold until the situation becomes clearer.

After a record €34 billion in 2018, France started 2019 at the same pace as 2018, with €13.7 billion invested. The market was driven by offices, which accounted for 70% of the total.

Most other European countries enjoyed an upward trend, with investment doubling – or close to it – in Belgium (+105%), Italy (+96%) and Spain (+88%). There were also large rises in Poland (+57%) the Czech Republic (+31%) and Ireland (+6%). Only Luxembourg (-22%), the Netherlands (-55%), and Romania (-65%) saw declines.

Foreign investment in European commercial real estate fell 10% year-on-year to €50 billion, with a significant decline in Middle Eastern investors of 24%.

European investors stand out

Larry Young, head of BNP Paribas’ International Investment division, says, “European investors stood out once again, even seeing an increase in their market share since the beginning of the year (45%). US investors, after a peak in activity followed by a withdrawal from the market in 2016, have since been oscillating around €25 billion annually. They invested commensurately in early 2019.

“Asian investors were less keen (-11%) but have clearly established their presence in Europe in recent years. Middle Eastern investors have been less present in 2019 (-24%) with investment coming in well below the long-term average.”

Although office space purchased in the 15 main European markets declined by 2%, the 4.75 million square meter volume for the first half of 2019 was the second highest in a decade.

Yet the overall figure includes major disparities, with some markets showing a distinct slowdown while others continue to break records.

Berlin and Hamburg broke their all-time records. As did Brussels, with investment more than doubling versus 2018 (+125%). Madrid had its best H1 performance since 2007, up 35% over a year. Milan was up 18%.

Among falling markets were Amsterdam (-27%), Central London (-18%), Central Paris (-16%) and Warsaw (-12%). However, they all remain in line with their long-term averages.

Looking to the rest of 2019, the outlook is bright for Paris, with several major transactions expected in H2 and London is faring better than expected even with the 31 October Brexit deadline looming.

High-quality offices in demand

Aymeric Le Roux, the executive head of International Advisory & Alliances, says high-quality offices are still in strong demand.

“Thanks to a healthy take-up trend for several years now, European office markets currently boast very low vacancy rates. This means that immediate supply is historically low in most major European cities and competition between occupiers for high-quality assets in the main business districts is as fierce as ever. Prime rents naturally reflect this trend and remain high throughout Europe.”

Consequently, the vacancy rate in Europe has contracted further to 6.2% on average. The lowest rates are in Berlin (1.7%) and Munich (2.2%).

The biggest falls have been in Warsaw (-260 basis points), Lisbon (-210 bp) and Amsterdam (-190 bp).

Prime rents have remained stable or increased in all the main European markets, apart from Central London, which is down 2% vs. H1 2018 to £1,211 per square meter, per year.

Hamburg, up 11% to €360 per square meter, per year, enjoyed the strongest rental growth. Other substantial increases came in Warsaw, Berlin (+9%) and Milan (+5%).

BNP Paribas Real Estate is a leading international real estate provider, with 5,400 employees, across 32 countries.

- Search for the latest CRE deals, including the fast-growing hotel and resorts sector, on Consorto.