Is European commercial real estate overvalued? A leading European financial stability watchdog thinks so.

Many EU countries have continued to see significant CRE price increases over recent years, but annual growth in sector lending has remained subdued, argues the European Systemic Risk Board (ESRB).

With investors demanding greater yields, prices have risen strongly, particularly in prime markets. This leaves investors vulnerable to mispricing of risks and also excessive risk-taking, according to ESRB’s 2018 Annual Report, which covers up to 31 March 2019.

Mario Draghi, Chair of the European Systemic Risk Board, says, “Most of the countries for which commercial real estate (CRE) price data are available have registered CRE price increases and signs of overvaluation, while bank credit for CRE has been muted.”

ESRB closely monitors the sources of systemic risk in the European financial system and the economy. It says the main risk to the market is the repricing of risk premia in global financial markets. This is followed by persistent weaknesses in balance sheets of EU banks, insurers and pension schemes, debt sustainability challenges in EU sovereign, corporate and household sectors and vulnerabilities in the investment fund sector and also risks from shadow banking activities.

So, is European commercial real estate overvalued?

So, is European commercial real estate overvalued? The ESRB believes it is in some markets.

“This is particularly relevant against a backdrop of policy uncertainties and faster-than-expected moderation of economic growth.

“Further increases in residential and commercial real estate prices point to signs of overvaluation in some markets.”

The year to 31 March 2019 saw a high level of policy uncertainty and faster than expected moderation of economic growth.

Economic sentiment indicators decreased in most EU Member States and public and private sector forecasters revised their projections of output growth.

Economic confidence in Europe is highest in Hungary, Croatia, Lithuania, Cyprus and Slovenia. It is lowest in Slovakia, Finland, the UK, Italy and also Greece.

In view of weakening economic growth, economic policy uncertainty, geopolitical tensions and prevailing vulnerabilities in Europe, the risk of a repricing in financial markets continued to be high in 2018, says the report.

“Looking ahead, asset classes which have experienced a compression of risk premia due to the search for yield during recent years (e.g. corporate bonds, leveraged loans, real estate segments in some countries and certain stock markets) are particularly at risk of price adjustments as the economic outlook moderates and market sentiment deteriorates.”

Austria tops CRE annual percentage growth in Europe

The relatively favourable economic conditions across Europe in recent years and low interest rates have led to increasing demand for housing and also rising prices.

In certain economies, this has also contributed to increasing household indebtedness to finance housing purchases, making the housing market vulnerable to changes in economic conditions.

“In many EU countries, the positive house price dynamics have been coupled with signs of overvaluation, which could generate losses for banks and other financial intermediaries involved in real estate financing should the real estate market experience a significant downturn.”

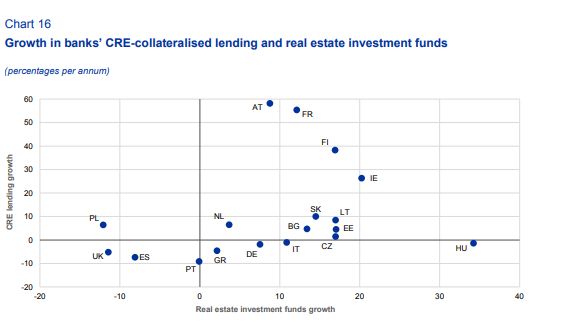

Austria has seen the biggest annual percentage growth in CRE lending and investment fund growth, followed by France, Finland and Ireland. There has been negative growth in lending and investment funds in The UK and also Spain.

While changes in the investor base and funding sources have increased risk sharing, they have also opened up other forms of interconnectedness and other transmission channels that have a bearing on financial stability. “Few macroprudential measures have been implemented so far in the EU countries that directly target CRE vulnerabilities, though some instruments, which mainly target the banking sector, are available to macroprudential authorities seeking to address these vulnerabilities,” says the report.

Most EU countries have implemented a loan-to-value (LTV) measure only, while a few countries have adopted a combination of measures. There may be a need to introduce and/or activate borrower-based measures in some countries, potentially also covering the non-financial private sector.

Looking to buy or sell commercial real estate? You can list and browse top CRE property for free on Consorto.